A Woman's Touch: Women-led Companies Perform Better

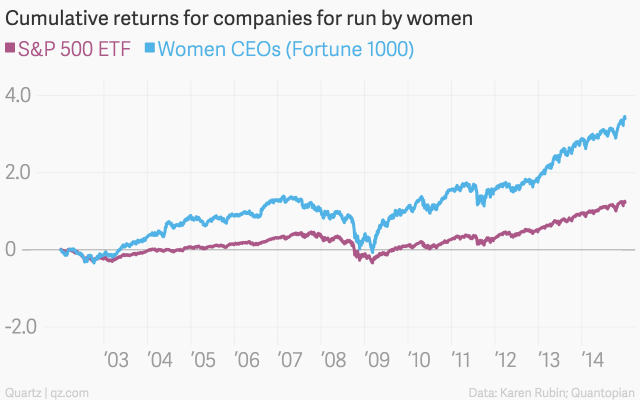

There are many reasons to increase the number of women working in leadership for the world’s top companies. With increased diversity comes greater creativity, innovation and consumer reach. But the best reason to put women in positions of leadership is much more black and white: women-led companies perform better, leading a 340% return vs. 122% for the S&P 500 benchmark.

As part of an ongoing project from Karen Rubin, who works as the director of product for Quantopian, a crowd-sourced algorithmic trading platform backed by Khosla Ventures, Spark Capital and Bessemer Venture Partners, Rubin set out to correlate female leadership to superior stock performance. So she created an algorithm to test the theory (h/t Fortune). Her algorithm calculated the returns to investors in every Fortune 1000 company over the period when it was run by a woman. She then compared that to the performance of S&P 500 companies. The results showed women-led companies render a return 218% greater than the S&P 500.

These results are even more interesting when you consider that women are disproportionately hired to run companies that are in deep trouble. (think Mary Barra at GM or Marissa Mayer at Yahoo.). Additionally, research which shows that companies are quicker to fire women when a company is underperforming, a fact that would potentially limit the downside: she’s gone before the stock has fallen too hard.

Ultimately the best test of how women perform as CEOs is to get more women into the leadership pipeline. Currently women account for an outrageously small percentage of CEOs of S&P 500 companies: 4.6%.